Multinational organizations of all sizes are adopting technology-driven solutions that optimize and automate key business functions like HR, Finance, Sales—and, increasingly, Payroll. Now, years into this digital revolution of work systems, the value of integrating related solutions is evident in minimized risk, time, and costs.

Yet, the interdependent functions of Payroll and Payments remain distinct from each other within the majority of companies, withholding those benefits and more from both teams, as well as from the larger organization they serve. Aligning processes and automating data movement where personal financial information is concerned has never been more important from a regulatory standpoint, but the benefits of deepening the connection between Payroll and Payments extends well beyond compliance—affecting everything from employee retention to operational performance to organizational agility.

The latest report from CloudPay explores the benefits of a closer connection between Payroll and Payments, and the impacts of maintaining separate systems — such as on risk and compliance, employee confidence, and cost control. For complete details, download the full report.

Risk & Compliance

Companies collect and process sensitive employee data to facilitate compensation, placing the Payroll and Payments functions at the heart of regulatory concerns and legislation worldwide.

When it comes to issuing payments into countries in which a company doesn’t typically maintain funds, compliance risks can compound further. Legislative requirements in different jurisdictions may change frequently, as even basic aspects of how tax and contributory payments must be made within countries are constantly reviewed as financial bodies streamline their own processes.

To keep up, organizations must maintain a global payments solution that not only meets current needs but is ready to adapt with changing legislation. Some of the variables a system must account for include country-specific banking requirements, currency, payment type, and payment method, as well as any legal regulations.

Employee Confidence

As levels of competition for talented employees and in-demand skills rise around the globe, organizations are focusing more attention and resources on the employee experience, with a goal of securing their existing workforce and boosting recruitment.

Any failure to maintain an effective payments solution could be devastating to employees’ perception of a company’s commitment to its workforce or to its stability as a business. Repeat delays or mistakes will compound that effect, regardless of whether the fault lies with the company itself or with the third-party responsible for making the payments.

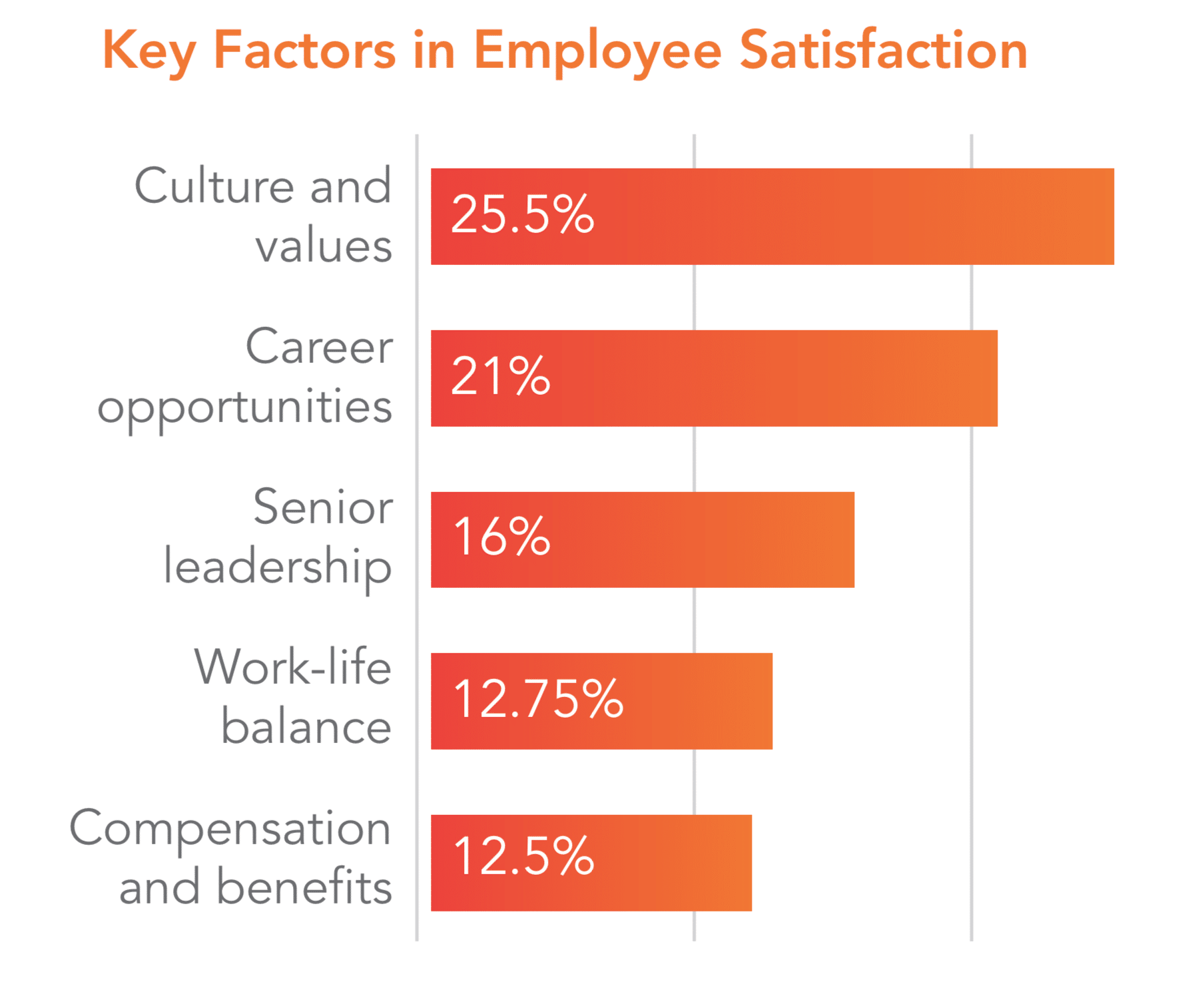

It’s been proven that higher rates of employee satisfaction can lead to greater company performance, and further analysis shows that timely payment of payroll is key to a positive employee experience. In fact, employees consider timely, accurate payment to be reflective of a company’s culture and values, which has been found to contribute approximately twice as much to overall job satisfaction as compensation and benefits.

Cost Control

A barrier to understanding persists when it comes to the costs of making payments. Companies tend to view the amount of a payment as the only cost involved, but there are many additional charges, fees, and losses incurred that contribute to the total cost of a payment, including lost income on reserved funds, FX costs for currency conversions, and more.

Some of the additional costs are straightforward and easy to understand and calculate. However, others are more nuanced and require both expertise and knowledge of current rates and trends to estimate. For example, when money is held in a local account waiting to be paid out, it’s not earning the interest income that it would in the primary corporate account. In that case, Payments teams would want to move those funds into holding as late as possible, to maximize the interest earnings. Any delay in the payments being made means more interest income is lost.

Aligning Payroll and Payments workflows and integrating data as much as possible between systems enables better time management across functions to help control costs overall.

{{cta(‘d624bb8c-f972-4f22-9d91-636f0790a7a2’)}}