Global payroll processes and the technology around them are changing at pace. This means that operational expectations across human resources (HR), finance and payroll teams are something of a moving target and confidence about keeping up isn’t always matching reality.

We recently conducted detailed research into the payroll maturity and readiness position of 200 senior HR, payroll and finance leaders all over the world. Among the insights we’ve uncovered, we’ve been able to establish a ‘payroll readiness maturity curve’, in which different organizations can be grouped across four different readiness stages.

In this blog, we’ll explore each of those four stages of the curve, so you can identify where your business is on its payroll maturity journey, and make informed decisions on the road ahead.

Introducing the payroll readiness maturity curve

Future payroll readiness is a far more nuanced proposition than you might think. This applies whether you’re a mid-market organization that’s agile but light on resources, or an enterprise that is well-resourced but can be slow to react due to complex and fragmented systems.

Each of the four parts of the maturity curve brings its own characteristics, risks and opportunities, and reflects a particular reality from which you can assess what to do next. Let’s take a look at the payroll readiness maturity curve and each of the four stages in detail.

Stage 1: Perceived readiness

Organizations at this stage on the curve are those that have confidence in the future, but without proof of readiness progress. Manual payroll processes are still prevalent, forecasting is inconsistent, and compliance and cybersecurity are reactive as a result.

Our research has found that nearly a quarter of mid-market organizations (24%) remain reliant on manual or limited approaches to cost forecasting. And even at enterprise level, 61% of businesses are still reactive or manual in their forecasting approach.

Stage 2: Pilot readiness

This is the stage in which organizations drive localized wins by applying elements of automation, AI or APIs in fragmented isolation, with highly specific use cases. In midsize organizations, this fragmentation is often down to skills gaps that prevent wider adoption: 28% of those businesses cite this as a primary obstacle.

However, this can also be an issue for larger businesses, too. While nearly 90% of enterprises said they felt ready to adopt automation, AI and APIs, the reality of the complexities around adoption means many organizations are struggling to do so.

Stage 3: Scaled readiness

Organizations that have reached this stage have achieved a degree of standardization across different countries and systems. This means they have consistent payroll processes, unified payroll data, and coordinated global payroll governance.

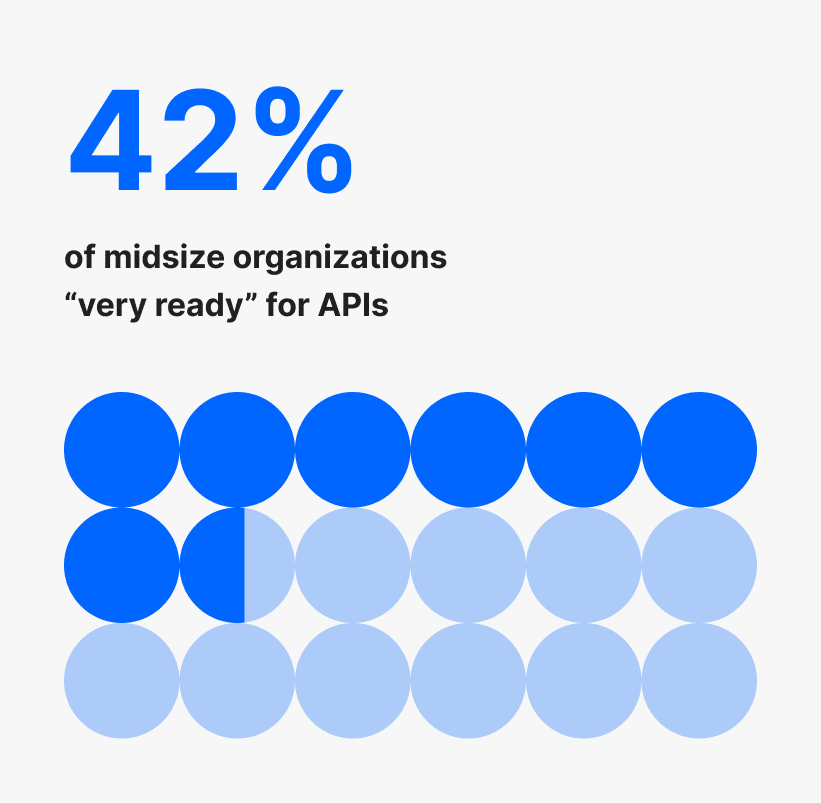

We’ve found that businesse reaching this stage often require outside help from payroll partners and providers. For example, only 42% of midsize organizations say they’re “very ready” for APIs, and 28% say a lack of integration skills are hampering their path to modernization. Even a majority of enterprises (57%) rely on payroll software and providers for compliance updates and information.

Stage 4: Proven readiness

This is the highest degree of maturity, where organizations can demonstrate measurable value from their payroll processes, automation initiatives, and technology. These are, generally speaking, the companies that feel the most confident in their payroll but they remain in the minority.

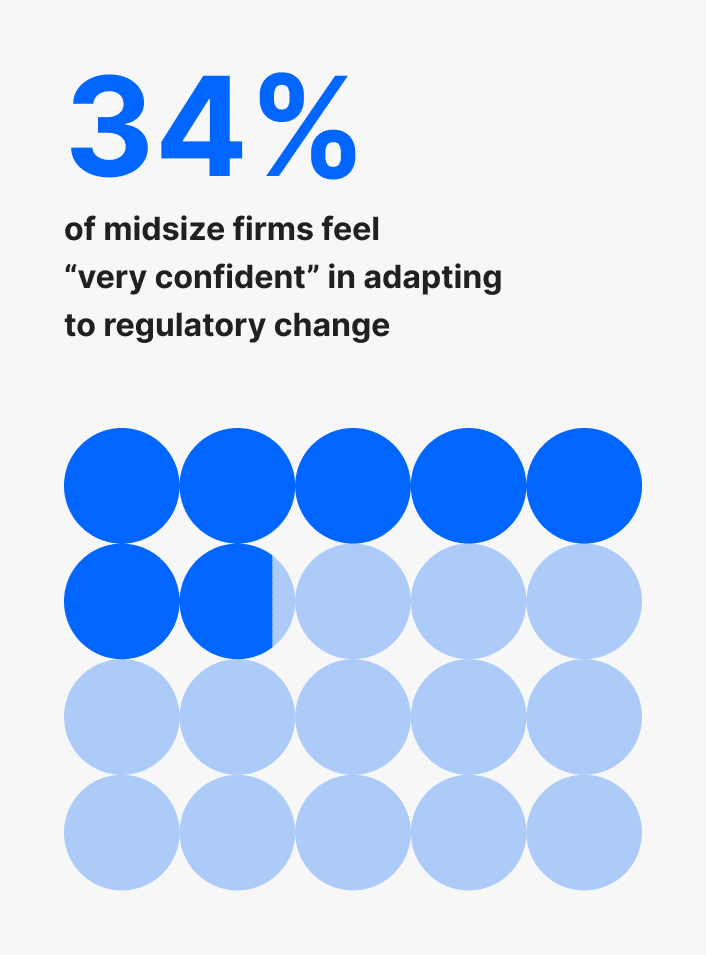

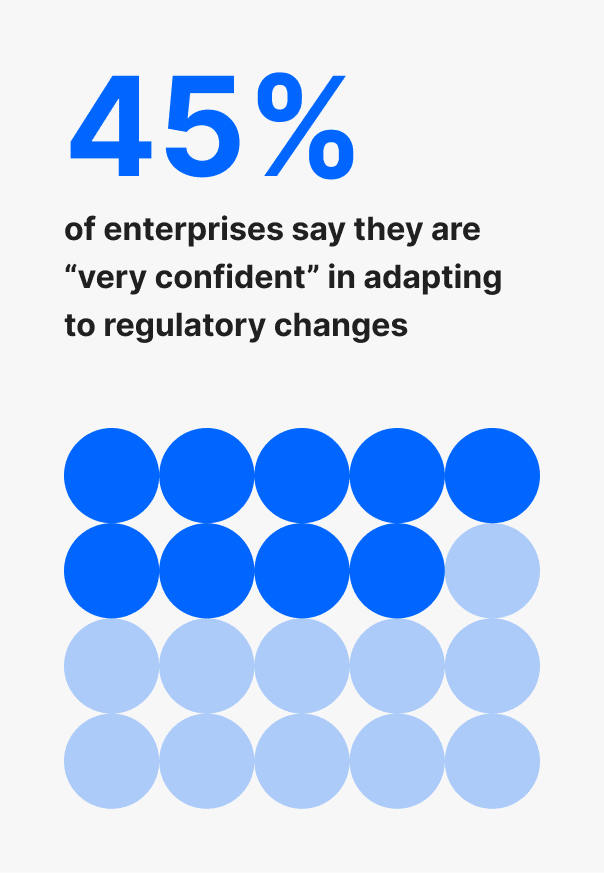

When it comes to adapting to regulatory changes, only 34% of mid-market organizations and 45% of enterprises said they felt “very confident”. Results for confidence in ability to protect payroll data are similar, with 37% of midsize businesses and 39% of enterprises expressing high levels of confidence.

Readiness is continuous and measurable

It’s important to remember that every organization is constantly moving along this curve — potentially in either direction. Readiness should be considered a constant measurable journey rather than a destination, and every stage requires full visibility, strong governance, and an iterative approach to adopting technology and changing payroll processes.

As technology advances, regulations shift, and global economic pressures fluctuate, even organizations that currently sit at the most advanced stage of maturity will need to reassess their readiness regularly. What constitutes “proven” readiness today (such as implementing AI or achieving full payroll integration) may become tomorrow’s minimum standard.

This is why future readiness should be seen as a living discipline: one that requires continuous measurement, cross-functional collaboration, and the ability to quickly adapt to disruption. From geopolitics and compliance changes to evolving employee expectations and technology capabilities, the readiness curve isn’t static and neither should your approach to payroll be. Keeping up means building systems, partnerships, and cultures that are just as agile as the world around them.