To almost all of the people reading this blog, getting paid by direct deposit into a bank account is such a normal thing that we don’t really give it a moment’s thought. It’s easy, therefore, to assume that the same is the case for every worker, all over the world. But the reality is somewhat different.

The Federal Deposit Insurance Corporation (FDIC) defines unbanked as a household where no one has a checking or savings account at a bank or credit union. Whereas, underbanked, refers to a household that has had a checking or savings account but also obtained alternative financial services outside of the banking system

There are still huge numbers of people around the world who don’t have access to bank accounts, and many of them are in developed countries. However, companies still have a responsibility to ensure these people get paid accurately and on time. How can this be done?

This blog explores the state of the unbanked and underbanked, and explores alternative financial services and payment methods to what we would consider the norm.

The reality of the unbanked

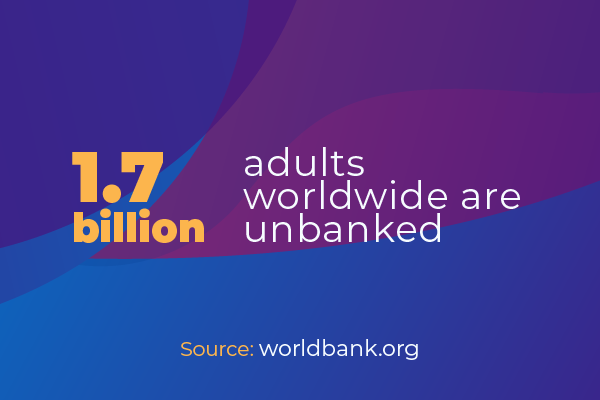

It’s estimated that there are around 1.7 billion adults worldwide who are unbanked, meaning that they do not have access to a bank account. This is especially the case in developing countries: in Morocco, Vietnam and Egypt, more than two-thirds of the population are unbanked, but it’s also estimated that there are around one million unbanked adults in the United Kingdom.

There are many different reasons why people may be unbanked. The lack of a steady employment income , and financial difficulties like bankruptcy and a bad credit history, are common factors.

Additionally, people may not have convenient access to banking, or if they do, struggle because of a language barrier. And some people simply don’t trust banks to take care of their money and choose to opt out of the banking system.

As well as the unbanked, there are also millions of people who are considered ‘underbanked’, where they have a bank account but don’t earn enough to use it fully, or to establish any form of credit rating. These are people who normally have to explore alternative financing to pay bills and buy goods, such as hire-purchase.

Whatever the reasons for being unbanked or underbanked, businesses still need to help those people earn money, and the obvious methods would be to pay them with a paper check or in cash. But those methods can be problematic: as check cashing has to be done by unbanked employees which takes time and effort, and can incur a processing fee. Cash, meanwhile, needs to be held by employers for physical payment to employees, and therefore can be prone to human error (i.e. miscounting) or theft.

How you can support unbanked employees

Thankfully, the advent of technology means there are now far more options available for easily connecting employees to their earnings.

For example, the World Bank estimates that two-thirds of the 1.7 billion unbanked people worldwide have mobile phones that can be used to access financial services. Online money apps/providers can therefore be used by employees for financial transactions, and employers can pay wages directly into these apps.

The fact that there are so many different apps available, and that many of them are free to use, removes any cost or bank fee barrier that may deter some unbanked people from traditional banking. It is worth noting, however, that employees will naturally need a reliable cell phone signal to be able to conduct transactions, and that while the acceptance of mobile payment by businesses is increasingly common, it isn’t universal across all retailers worldwide yet.

Another useful technological tool is a digital payroll card. This works in exactly the same way as a normal debit card, but it’s issued by the employer rather than by a financial institution. Payroll teams can transfer wages through direct deposit straight onto the card on payday, and employees can then use this prepaid card for spending, bill payments or money transfer just like a traditional bank account.

This gives employees lots of flexibility in their personal financial lives, although there can be high fees involved with these cards, and the laws around their use aren’t particularly well-defined in some territories.

In summary

At a time when companies are exploring new markets and expanding into more countries, ensuring that there are means to pay unbanked and underbanked employees is important. That there are now tech-enabled options available making the use of alternative financial services easier than it has been in the past, but it’s important to consider all the pros and cons before implementing any solution.

CloudPay’s expertise in global payroll can help businesses like yours seamlessly run payroll in ways that make sense for you and all your employees – whatever their banking status. Take a closer look at what we do here.