The cumulative benefits of CloudPay’s automations

In a fast-paced, digital-first world, payroll can no longer afford to be reactive. Delays, manual checks,

and fragmented communication may have defined the old norm – often resulting in inefficiencies and

eroding trust in the process. At CloudPay, we’ve made it our mission to change that.

Over the past year, we’ve rolled out a suite of smart automations that are quietly, but profoundly,

reshaping how global payroll is delivered. These are deeply considered, context-aware solutions

designed to deliver consistency, accuracy, and transparency, at scale.

This is payroll reimagined with technology to enhance payroll processes,

but keeping humans in full control.

A framework built for confidence

At the heart of our automation strategy are three foundational functions. Each one is made up of multiple

automations and is designed to remove friction, reduce risk, and elevate the payroll experience for

practitioners and employees alike.

1. Data importing

and locking

Every great payroll run begins with all the right data in place and ready to go. But manually managing file submissions, coordinating cut-off times, and validating data quality can drain resources and invite errors. Our Data Import automation ensures that all the right data is where it needs to be. The system automatically gathers the inputs and then our Data Lock automation locks the run when complete, so processing can begin with total confidence.

The result? Payroll and payment teams can focus on reviewing exceptions, rather than chasing spreadsheets, ultimately moving from a mindset of “data wrangling” to “exception handling.”

2. Validation from

start to finish

Traditional payroll validation is reactive and fragmented. Ours is proactive and continuous. Built-in automation handles validations at three key stages: before processing, after processing, and after final approvals. This tri-layered approach ensures that issues are either flagged early or immediately after processing, before they can disrupt pay day.

These automations are context-aware, meaning each one knows what should have happened in previous steps and flags anything that didn’t take place but should have. That’s smart automation. That’s peace of mind.

3. Output generation

and publishing

Once a run is validated and approved, the final outputs (GL files, bank files, and payslips) are automatically generated and queued for publishing. No need to manually trigger steps or double-check completion. It’s all built into the workflow, with visibility at every turn.

This is payroll to payment automation that doesn’t just do. It shows.

Visibility that builds trust

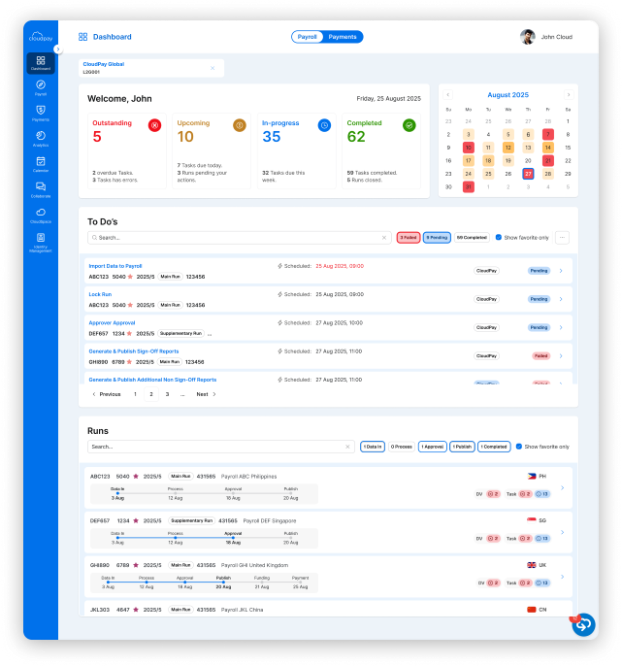

Automation should never feel like a black box. That’s why CloudPay makes every automation step visible

through our workflow interface. Optional manual overrides provide flexibility whenever needed.

Need to check the status of payslip publication? You’ll see the task, its current state, and whether it

completed automatically or was handled manually. Waiting for a bank file to go live? It’s right there

on the timeline: pending, completed, or in progress, with notifications and alerts for every change.

CloudPay’s Payroll and Payments unified dashboard.

This transparency not only empowers payroll and payment teams, it reassures the employees they serve.

They know their pay is in motion, even before it hits their account.

Automation meets accountability:

Issue management framework

A key, yet often under-recognised, benefit of process automation lies in the operational infrastructure it enables.

It doesn’t just improve the core task. It unlocks systemic improvements in the surrounding operational framework.

With CloudPay, an integrated end-to-end Issue Management Framework is built into every payroll run, in every

country we operate. This framework logs, tracks and resolves payroll and payroll-to-payment issues whether

they’re auto-generated by the platform or identified and raised manually by practitioners.

The result is that standard industry pains can now be left in the past:

What’s next?

For more information on what our cutting-edge payroll automations can offer you, visit our Automations page.

And if you have any questions about your particular payroll pain points and how we might be able

to help you, get in touch with our team of high-performance payroll people.