COMPANY PAYROLL: STATE OF PLAY

-

54%

of companies say there is room for improvement in their current payroll policies and practices1

-

35%

of all payroll errors are caused by manual data entry2

-

22%

of payroll inquiries relate to employees ‘missing pay’ from their expected paycheck3

MEET SALLY...

-

An HR Director for a UK-based SaaS company, Sally started with a four-person payroll team, responsible for handling pay for the company’s 780 employees across five countries. She loves the job and she’s great at it: building relationships and watching people grow.

But in the past two years, it’s not just the people she’s seen grow. It’s the entire business. And with it, Sally noticed the stress her team was under.

Those 780 employees had increased to 1,100; projected to hit 1,250 by the end of the year.

And those five countries? They’d expanded to 12, including regions with tax and compliance complexities they’d not experienced before.

-

Before long, her team was working late nights juggling countless spreadsheets and a staggering array of payroll vendors, compliance issues and manual payroll entries.

Then came the company-wide restructure. With more new employees and organizational changes came more manual data entry and accompanying mistakes.

Sally knew there had to be a way to build a better, future-proof global payroll operation that could take the strain off her overburdened team.

She wanted to challenge the status-quo. To build better, future-proof HR and take the strain out of her ever-expanding payroll operation.

With nine payroll vendors servicing multiple countries, each with different compliance and payroll requirements, what was the best way forward? Could she rely on fewer vendors? Can they deliver on the business needs? Is there a simpler way to manage multi-country payroll?

SO MANY CHALLENGES. SO MANY QUESTIONS.

The challenges Sally faces have been experienced by CloudPay clients all over the world.

For HR leaders tasked with managing complex global payroll needs and keeping pace with employee moves – all against a backdrop in which HR is being asked to enhance the employee experience – the starting point often looks something like this:

-

Fragmented global payroll processes

Lack of global

payroll visibilityPoor employee experience

-

Manual data entry & input errors

Poor data &

reporting qualityLack of compliance

Frustrated

employees -

Stressed team

Frustrated staff

Slow

communications

LOOK FAMILIAR?

That was Sally’s day-to-day. So she spoke with a few of her current payroll vendors about her challenges, but they offered no good options. Her requirements were either too complex, too specialized, or they simply couldn’t connect the dots. Frustrated, she reached out to an old colleague who’d also recently changed their HCM.

That’s how Sally found CloudPay.

FINALLY, SOMEONE WAS SPEAKING HER LANGUAGE...

Sally sent them an RFP to assess their global capabilities. The business case they presented to her a few weeks later blew her away.

Payroll process synchronization. Certified integrations with HCM platforms, including Workday, and the ability to publish payslips, tax and multiple payroll docs in one location. Compliant with local requirements. New employee pay models, such as pay on-demand. They even offered global payment services to expedite salary fulfilment worldwide. It was all there. But in a single, centralized solution? Surely not.

Sally had built a great relationship with John at CloudPay, so she dropped him a line. John allayed Sally’s concerns, assuring her that CloudPay could indeed meet her expectations. He proposed an initial discovery meeting to connect with Sally’s key stakeholders.

FROM DISCOVERY TO DECISION

Sally introduced John to her Finance Director and Global Head of IT a couple of weeks later. She’d already completed John’s initial insights questionnaire so they could hit the ground running in their discovery call. John explained how the next couple of months would run.

A REWARDING ONBOARDING

With an agreed project map in place, it was time to get going. John remained in the frame, while handing the reins over to his implementation team, who worked with Sally and her core delivery team over the next eight weeks of onboarding.

-

Phase Zero: Implementation Readiness

CloudPay introduced Sally to her dedicated Implementation team: a dedicated Project Leader and several Implementation Consultants and technical experts, who would guide the project from initial kick off, through to final delivery.

They explained their process: from gathering data, to running payroll and sharing insights from their efforts.

Together, they steered the project through its first implementation stage. Sally introduced them to her in-house Data Manager, IT Architect, and her HCM system account team to ensure full collaboration on the integration.

-

Understanding the data

The CloudPay Implementation team did a deep-dive into the company’s payroll data to understand their current payroll and HCM data journey, inside and out.

They provided country-specific questionnaires to extract specific insights and challenges; what data went where and why, by whom; where the bottlenecks were, and what standardization existed.

CloudPay traced and validated every piece of payroll data available to them, and came back with their findings.

-

Agreeing the milestones

For the first time in years, Sally could clearly see how the global payroll process should work.

The CloudPay team walked everyone through the proposed implementation process for their global payroll operations on Workday, as well as the global payment services process.

Together, they refined milestones, agreed on governance and prioritized the order of work by country.

Sally’s remaining concerns were around the transition process, and how they would manage any risks.

THE NEXT THREE MONTHS BELONGED TO IMPLEMENTATION

-

Month 1: Design

With all teams having met at onboarding, CloudPay’s Project Lead commenced the design phase.

Mapping out Sally’s current payroll – both technically and operationally – and filling in country-specific knowledge gaps by speaking with local payroll staff, they developed the blueprint for how Sally’s new payroll would run in CloudPay.

Meanwhile, a separate team focused on the payment services integration – marrying it up with the global payroll and HCM platform integration design.

-

Month 2: Configuration

With an agreed-upon framework for their first country rollout in place, the following weeks were spent configuring and syncing the technical components of the company’s HCM with the CloudPay platform.

System locations and data quality were checked, and country-specific.

-

Month 3: Testing

By month three, Sally and the team were feeling the fatigue. Fortunately, CloudPay’s implementation experts and her IT Architect had just confirmed: configuration was done.

Now, it was time to test. Running a parallel-run process for their UK payroll, they monitored reporting formats, tested payroll totals and matched outputs with Sally’s previous payroll. Of course, there were refinements to make. But it was working.

Sally shared the team’s progress with the business. The Workday HCM integration was completed. Their treasury services were up and running. They were ready to go live.

THE BIG DAY

The months of system design, data validation, team training and platform testing had all led to this day.

A single integrated payroll solution to support the company’s continued growth – complete with fully-supported global Treasury Services – standardized and simplified to help Sally and her team regain control. Her Payroll Manager ran payroll…

The UK went first. Then Germany. Then India.

Sally and the team checked their real-time global reporting. The CloudPay team checked their in-country analytics.

HR & PAYROLL IN HARMONY

Fast forward six months and global payroll is going well for Sally and the team. They’ve rolled CloudPay out to an additional four countries, having navigated some of the more complex territories. They’ve grown by another 12 heads in India – finding that onboarding employees has never been easier. They’ve managed to harmonize HR and payroll in ways they didn’t think possible.

Sally now has a centralized view of payroll performance, with data seamlessly flowing between Workday Analytics and CloudPay Analytics. Payslips and tax documents can be sent directly to employees . And with CloudPay’s payment services fully deployed, the company has greater visibility and control over delivering global salaries.

Sally now sees CloudPay as part of her extended team. They talk every couple of weeks. In fact, she’s working with them to help build a new general ledger and bridge a small finance reporting gap they’ve identified. They’ve also decided to deploy CloudPay’s pay-on-demand solution through CloudPay NOW – an innovative app that, among other features, allows employees to access their pay ahead of the scheduled pay period.

HR & payroll are working, which is a job well done for everyone’s stress levels. Not to mention the business advantages it’s unlocked.

In the end, Sally realized that what they needed, and achieved, was not just an operational change, but a transformational one that would see them into the future.

-

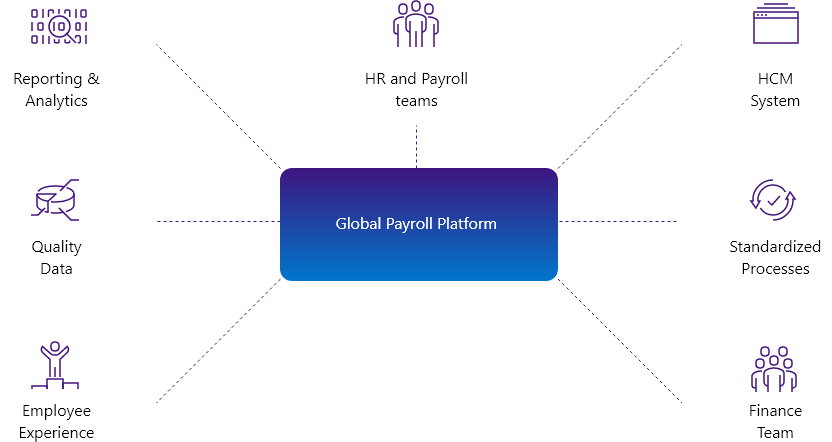

Reporting & Analytics

Reporting & Analytics

HR and Payroll teams

HR and Payroll teams

HCM System

HCM System

-

Quality Data

Global Payroll Platform

Quality Data

Global Payroll Platform Standardized Processes

Standardized Processes

-

Employee Experience

Employee Experience

Finance Team

Finance Team

WHAT DOES THAT MEAN FOR SALLY AND THE BUSINESS?

-

Efficiency

With one vendor to manage using standardized global processes, Sally’s team feels back in control.

When someone has a day off, it’s easy for the team to cover multi-country payroll for employees, contractors and gig-workers using a single platform.

These gains in operational efficiency were a huge win for Sally’s team. But it didn’t stop there: they improved the employee experience by offering new benefits like pay on-demand and in-app payslips.

-

Compliance

With centralized processes and a cloud-based platform that brings visibility to payroll and payments across 130 countries, Sally can monitor compliance across borders.

And with always-on global data analytics and built-in notifications and alerts that indicate a potential compliance issue, she can investigate and resolve compliance complexities with ease.

-

Growth

By bringing HR and payroll together, Sally can flexibly scale operations to align with recruitment drives and business growth – as well as process outgoing employees at speed – without adding complexity into the business.

Regardless of country-specific growth needs, everything can be managed centrally with complete visibility, all from a single system.

-

Integration

Before CloudPay, the business and its employees weren’t reaping the full benefits of their HCM system.

With global payroll now fully integrated with it, Sally and CloudPay have eliminated the manual data entry errors that were negatively impacting the employee experience and tainting HR’s wider reputation.

A few weeks later, an email popped into Sally’s inbox. It was someone from her HR network.

Message

“Sally – I hear you just integrated Workday with CloudPay! What’s it like?

We’re so stressed this side. I really need to make a change before it

becomes a bigger problem. Any advice?”

Sally reflected on what questions she’d ask today. Then she replied… well…

Message

Think about what problems global payroll causes your team and wider HR

today:

A diminishing employee experience?

Negatively impacting your retention and recruitment drives?

Poor visibility and control from managing too many vendors and systems?

Bloated costs from high re-run rates and supplemental runs?

Lack of integration with your HR systems?

Stressed payroll teams?

Now think about what you’d want to help solve that:

Having a payroll system that works with HR, not against it?

Decreasing payroll errors and costs by automating more of the payroll

cycle?

Empowering employees with innovative HR and payroll services?

Supporting a global or regional expansion into new countries?

Standardizing multi-country payroll processes and enhancing compliance?

Maximizing operational efficiencies between HR and payroll?

THE PATH TO HR AND PAYROLL HARMONY STARTS WITH EXPLORING THESE QUESTIONS.

By navigating your way through what’s not working – and mapping out what you want to achieve by implementing a truly global payroll solution – you’ll find your starting point.

And as you begin your journey, you’ll move closer to future-proofing your HR and payroll operations – championing a better employee experience. For all.