About the report

Scroll down and click through the different topics to read our report on preparing for the future of payroll in midsize businesses.

Introduction

Technology adoption

readinessCybersecurity

readinessCompliance readiness

Conclusion

It’s a changing

world out there –

and payroll is no exception.

Payroll is undergoing its biggest modernization in a generation, with automation, artificial intelligence, and APIs all becoming established as core payroll technologies that deliver key advantages to savvy adopters. So much so, that the question is no longer whether you should modernize payroll operations or not – it’s whether you’re ready to do so.

We’ve conducted detailed research engaging 200 finance, payroll and HR leaders from around the world, and uncovered a startling truth: confidence in future payroll readiness doesn’t match up to the size of the practical challenge of achieving it.

And while midsize organizations are suffering in particular, enterprises are also finding it difficult to follow up on their aspirations to modernize.

There’s no time to lose in addressing this confidence gap. Cybersecurity threats are evolving and strengthening. Regulatory demands are accelerating. Cost pressures are mounting.

And all this means that margins for error are shrinking all the time, and potentially leaving vulnerabilities that businesses like yours may not spot until it’s too late.

At CloudPay, we believe the best way

forward for future readiness is strength across three key pillars: technology

adoption, cybersecurity, and compliance.

All should be addressed together, as weakness in any of them will compromise

the strength of your core operations.

About

the guide

In this guide, we’ll establish the size of the confidence gap, explore the areas where the vulnerabilities lie for those at the biggest risk, and give you practical, actionable advice on how you can move from perceived readiness to proven readiness.

Our research

and methodology

To capture a snapshot of technology adoption, expertise, and future readiness in global payroll, CloudPay conducted comprehensive research with 200 senior decision-makers at multi-national midsize and enterprise organizations. All respondents submitted their views between September 8-24 2025.

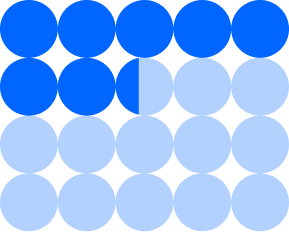

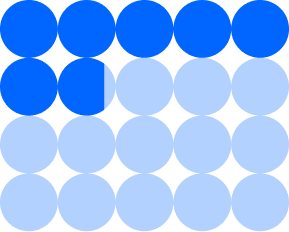

Our respondents

We asked these respondents a variety of quantitative questions on a range of key payroll issues, measuring responses on scales of importance and satisfaction. Equipped with the results, our experienced subject matter experts in product, engineering, compliance, and security have analyzed the findings to establish data-driven insights on the current state of play.

From these insights, we’ve been able to deliver practical advice and expertise on where and how organizations like yours can improve their readiness.

3%

Expressing ROI concerns

around modernization

7%

Satisfied with their current

costs and processes

Payroll modernization:

A midsize business readiness snapshot

Many payroll leaders feel that their organizations are largely ready for the future, whether that’s in technology adoption, cybersecurity resilience, or compliance adaptability. And they recognize that payroll modernization can deliver value, with only 3% expressing ROI concerns around modernization, and only 7% currently satisfied with their current costs and processes.

However, while enterprises have been more able to follow up on their confidence and positivity by taking the right steps towards readiness, midsize organizations are struggling to deliver on those same aspirations.

Automation, AI and APIs:

The uneven path to

payroll modernization

The headline figures around modern payroll technology adoption readiness look good for midsize organizations. Those who are “very ready” or “somewhat ready” number between 84% and 94% across all the key technologies that make up the ‘three As’: automation, AI, and APIs. But deeper analysis tells the true story.

However, this confidence doesn’t reflect

the actions and priorities we uncovered

among midsize organizations:

It’s likely that many of those growing firms that are only “somewhat ready” are struggling to turn vision into reality, and as a result, they risk being left behind in an increasingly automated landscape.

Cybersecurity:

Surface confidence

hides deeper concerns

The picture around cybersecurity is similar to that of technology adoption. While 89% of midsize firms have expressed at least some confidence around protecting payroll data, only 37% went as far as saying that they’re “very confident”. This is despite the fact that data security and cyber threats are the biggest payroll tech concern for businesses of all sizes (31% of midsize, 36% of enterprise).

The combination of feeling confident and recognizing security vulnerability indicates that, for many midsize firms, there may be scope to strengthen security resilience and increase cybersecurity standards.

37%

of midsize firms are “very confident” in their ability to protect payroll data from cyber threats

The biggest threats to payroll

specifically are cyber threats, insider

fraud and human error. Threat actors

are obviously interested in payroll

data because it leads them to identity

and financial theft.”

Tim Grieveson

Chief Security & Risk

Officer at CloudPay

34%

of midsize firms feel

“very confident” in adapting

to regulatory change

Compliance:

Midsize businesses

show greater uncertainty

Only 34% of midsize firms feel “very confident” in adapting to regulatory changes, while as many as 16% say they are “not very confident”. For enterprises, these figures come in at 45% and 10% respectively, underlining greater uncertainty for smaller organizations.

Businesses have access to compliance information and support from multiple sources, and the spread of sources used by midsize organizations is sizable. However, given they have smaller teams, it could be argued that this spread is too wide, as fragmented information can make it harder for resource-strapped teams to effectively coordinate a compliance strategy.

What does this mean for midsize

organizations?

It’s clear that enterprises are more assured in their capabilities, but often move and adopt more slowly. The opposite is true for growing businesses: they’re better able to embrace agility and openness, but face greater uncertainty around security and compliance, especially when they lack the in-house capacity and expertise to deliver on their modernization goals.

In the next three chapters, we’ll explore how to bridge the gaps between perceived readiness and proven readiness across technology adoption, cybersecurity, and compliance.

you’re currently reading

Introduction

As we explored in the previous section, midsize firms have several reasons for struggling with technology adoption.

Some 35% cite budget constraints, 28% a lack of integration

opportunities, and 23% dependencies on legacy systems.

We also found that midsize organizations are much more confident with automation – where 55% say they’re “very ready” for adoption – than they are for AI (43%) or APIs (42%).

In this chapter, we’ll establish what true readiness should look like for midsize organizations across all three of these cornerstone technologies.

Automation:

The foundation

The challenge

For growing organizations, the challenge of automation lies in scale and governance. Smaller teams risk over-automating without strong exception handling, which can lead to mistakes being exacerbated. When 95% of tasks are automated, the 5% of exceptions need careful human oversight.

As Sammy Molinaro, CloudPay’s Director of Solutions Consulting, explains:

“Automation is powerful, but midsize businesses must be strategic – each new option brings both opportunity and potential risk.”

The opportunity

Some 55% of midsize firms say automation is their biggest opportunity for cost reduction, which can be achieved through shorter payroll cycles, reduced manual input, and resources redirected from operational overheads to strategic initiatives.

The CloudPay approach of automating high-volume, repetitive processes first before expanding to more complex workflows can help deliver quick value for growing firms on tight budgets.

What true automation readiness requires

1.

Clear process mapping pre-deployment

2.

Clear process mapping pre-deployment

3.

Clear process mapping pre-deployment

4.

Clear process mapping pre-deployment

55%

say automation is

their biggest opportunity

for cost reduction.

These feel like micro-gains when we’re discussing them, but they add up very quickly in the complex web of system architecture that supports global payroll.”

Sammy Molinaro

Director of Solutions Consulting at CloudPay

AI:

Augmenting human expertise

The challenge

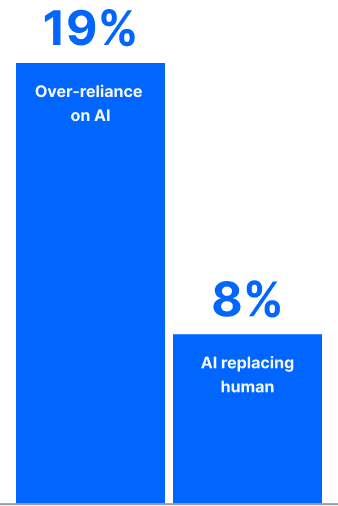

A lack of in-house AI expertise or careful planning can hinder the reliable deployment of and create understandable fear surrounding AI tools. This is perhaps why more midsize organizations are concerned about over-reliance on AI (19%) than about AI replacing human expertise (8%): they value the human skills needed to manage situations when systems fail.

The opportunity

AI can shift teams from repetitive tasks to strategic roles that reinforce employees’ value to an organization. This is because AI can reduce manual effort in data conversion, highlight anomalies, and move payroll teams away from processing and towards analysis.

We recommend deploying AI strategically across four areas:

AI isn’t magic—it’s just the intelligence layer. It can’t solve problems on its own without the right foundation.”

Sivan Golov

AI Strategist and VP of Product, CloudPay

Midsize businesses expressing

AI concerns

Efficiency and accuracy

OCR and AI models that scan and split complex documents, in conjunction with human oversight, to reduce error rates from one in 1000 to near-zero

Predictive analytics

Analysis of historical salary data, turnover patterns, and seasonal fluctuations to forecast future payroll costs and enable proactive workforce planning

Instant answers

An AI-powered knowledge base that aggregates common payroll questions and answers, enabling automated responses to employee queries and freeing payroll teams from repetitive support tasks

Security and compliance

Real-time analysis to detect fraud through unusual patterns, duplicate payments, and abnormal salary changes

What true AI

readiness requires

1.

Starting with lower-risk

pilots in back-office tasks

like data validation

2.

Keeping humans

firmly in the loop for

all critical decisions

3.

Using proprietary, secured AI models rather than public tools to protect sensitive payroll data

4.

Training teams to

understand and

validate AI outputs

APIs:

Integration as a competitive advantage

The financial case for the ‘three As’

Where these technologies can drive the biggest financial benefit is when they’re viewed as an integrated ecosystem rather than in isolation.

For midsize organizations in particular, three key actions stand out to make this integrated capability a success:

1.

Investing in digital skills for payroll leaders, so they can evaluate and guide technology decisions

2.

Proving value through controlled pilots before gradually expanding towards a wider transformation

3.

Partnering with vendors who can provide the integration expertise and implementation support that leaner teams often lack

Together, the three As create a closed-loop system that is scalable, data-driven, and continuously improving.”

Pedro Bravo

Senior Director of Engineering

at CloudPay

In which areas do midsize organizations

expect to generate cost savings through

payroll technology modernization?

Multiple responses were permitted.

The payroll professional’s perspective

Technology

As a payroll professional, you’ll know that technology is now doing much more than advancing the tools at your disposal: it’s fundamentally reshaping your job role. And as a result, your attitude and approach to technology may have to change.

Technology adoption is no longer the only goal. Now, it’s about strategically implementing tools that elevate your professional capabilities.

In the case of the ‘three As’:

Automation will take care of many manual processing tasks for payroll teams, freeing up time to focus on strategic analysis instead

AI can give you valuable insights across data anomalies and future payroll trends, give your employees instant answers to questions, and help you track and improve KPI performance

APIs and the real-time data connections they enable will ensure the data you’re working with is always centralized and ready for processing or analysis, no matter which system you’re viewing it from

The ability to adapt and strategically use emerging technologies is now as crucial as your foundational payroll knowledge, and will help payroll managers to act as strategic advisors and value-adding professionals for their organizations.

Out of numerous major security concerns,

midsize organizations recognize that data security

and cyber threats are their biggest risk

Multiple responses were permitted.

31% of them cited it as their biggest concern, more than any other. But only 37% of them

say they are very confident in their ability to protect payroll data, which is concerning, given

the risk of both internal and external threats causing breaches and major financial loss.

However, technology is only one part of the story. People and processes are just as important in maintaining a secure culture, especially with younger payroll professionals who may lack the experience with traditional payroll mechanics to spot anomalies or validate automated outputs. And in any case, formal cybersecurity training for payroll professionals in midsize businesses is relatively rare.

For this reason, any security technology should be dovetailed with foundational payroll security knowledge for all staff; digital skills training across APIs, automation, and their risk profiles; and wider security awareness encompassing phishing, social engineering, and unusual activity.

It’s about making sure that security is not just a compliance tickbox, but that it enables the business to do the business that customers expect, in a safe and secure manner.”

Tim Grieveson

Chief Security & Risk Officer

at CloudPay

What true cybersecurity readiness requires

1.

A partner with embedded protections and security built into the core payroll platform

2.

Support and planning for emerging threats, such as quantum decryption

3.

Regular security training so that teams can spot anomalies and potential fraud

4.

Continuous monitoring, stress-test processes, and rapid incident response

5.

Service partners that meet robust security certifications like ISO 27001 and SOC 2 Type II

Ultimately, payroll job roles now extend beyond processing payroll and encompass guardianship of sensitive financial data, making you a proactive cybersecurity partner. In this context, training in spotting anomalies, recognizing social engineering, and maintaining data integrity is crucial.

Previous

you’re currently reading

Cybersecurity readiness

Next

Amid an international landscape of increasingly intricate

and swift regulatory shifts, midsize organizations don’t

share the same confidence of enterprise firms in adapting

to compliance change.

Only 34% say they are “very confident” they can adapt

(against 45% of enterprises), while 16% say they are

“not very confident” (compared to only 10% enterprises).

This lack of confidence is important, due to the severe consequences

of compliance failures: fines, operational disruption, reputational

damage, and even the inability to pay employees in full and on time.

The opportunity

The best way forward for midsize organizations that are limited in resources is a combination of technology that automates compliance monitoring and up-to-date human expertise, delivered by a trusted service provider.

Together, they will be able to deliver:

Centralized compliance infrastructure

Covering all operating markets and tracking all changes from a single platform

Proactive change management

Identifying trends and updating systems globally, by following an agreed protocol,

rather than reacting to individual regulatory changes

Coordinated, in-country expertise

Where service partners in each region provide their own global insights to a central team, which turns that into actionable, centralized guidance

Centralized, auditable data

A single source of truth for payroll data that can be made immediately available for audits or when rapid incident response is needed

Beyond regulatory compliance

Modern compliance isn’t just about meeting the requirements of today –

it’s about having the tools and support in place to adapt to the unexpected

demands of tomorrow. This covers three key areas:

What true readiness requires

1.

Centralized

compliance oversight

2.

Automated audit trails

for every payroll action

3.

Providers embedded as strategic partners

in compliance management

4.

Access to in-country expertise

and legal interpretation skills

5.

Proactive testing of

operational resilience

6.

Systems that can deliver

compliance data on demand

7.

Technical change management to

update systems and processes

Understanding global regulatory trends and leveraging technology and strategic partnerships will be vital in managing compliance, ensuring that it delivers organizational resilience rather than just ‘following the rules’.

From perceived readiness

to proven readiness

CloudPay’s approach:

The ‘three A’s, combined with expertise

A strategic payroll partner like CloudPay can deliver the perfect blend of expertise, infrastructure,

and support. Our cost-effective approach for midsize organizations brings all the key functions

of future payroll readiness together, in a comprehensive out-of-the-box solution, designed with

scalability and simplification for midsize businesses front and center:

Technology

foundation

A unified global payroll

platform with fully integrated automation, AI, and APIs

Expert

implementation

“High-touch” implementation support that is proactive,

hands-on, and bridges the

skills gap growing organizations face with integration

Built-in security

and compliance

Enterprise-grade security

(ISO 27001, SOC 2 Type II)

and embedded compliance expertise across all operating markets – capabilities that would be impossible for smaller teams to build internally

Continuous

partnership

Ongoing support that ensures technology always delivers value

as your business and the

regulatory landscape evolve

Key takeaways

For midsize business payroll leaders

Assess your true readiness,

not just confidence levels

- Evaluate actual capabilities across technology, security, and compliance

- Identify specific gaps between the current position and the overall goal

- Prioritize areas that present the greatest risk or opportunity

Don’t let budget constraints

delay necessary modernization

- The cost of inaction often exceeds the cost of investment

- Phased implementation proves ROI quickly, funding further transformation

- Strategic partners’ expertise and efficiency can reduce implementation costs

Recognize that integration

skills are make-or-break

- 28% of midsize organizations cite skills gaps as their primary obstacle

- Partner selection should prioritize implementation support, not just technology features

- Look for “high-touch” providers who bridge the gap between your team’s capabilities and what’s required

Approach the ‘three As’ as an integrated

capability, not individual tools

- Automation, AI, and APIs work

best when deployed together - Piecemeal implementation

limits their value - Unified platforms reduce integration burden and accelerate time-to-value

Leverage your agility

- Midsize organizations can move

faster when properly supported - Use your flexibility to pilot new approaches and prove value quickly

- Don’t wait for perfect conditions – learn and adapt as you go

Make security and

compliance proactive

- Build incident response plans

before incidents occur - Partner with providers already preparing for emerging threats such as quantum decryption and deepfakes

- Ensure operational resilience through alternative payment methods and business continuity planning

Ready to

turn readiness

into reality?

Future readiness in payroll isn’t a destination – it’s an ongoing

journey. By combining your natural agility with the right strategic

partnerships, you can effectively compete with – and potentially

differentiate from – enterprise competitors.

CloudPay’s team of experts can help you assess your current

capabilities, identify priority areas for improvement,

and build a roadmap for proven future payroll readiness.

Ready for readiness?

Previous

you’re currently reading

Conclusion