Regulatory complexity and payroll efficiency don’t usually go hand in hand. In fact, the assumption is usually that stricter payroll compliance requirements inevitably lead to longer processing times and higher payroll error rates.

Spanning Europe, Africa, and the Middle East, the EMEA region is one of the most fragmented payroll landscapes in the world — dozens of countries, each with distinct employment laws, tax regulations, and statutory requirements. The regulatory complexity alone demands time-consuming diligence and accuracy.

Yet our 2025 Global Payroll Efficiency Index reveals something different. EMEA achieved:

- The lowest rate of payslip issues at 3.63 per 1000, compared to 4.51 for Asia Pacific and 5.95 in the Americas

- A reduced calendar length of 7.1 days, compared to 8.2 days last year

- Only a slight reduction in first-time approval rate, down just 1.05 percentage points to 66.86%

These results fundamentally challenge the assumption that complexity must compromise efficiency. So how are companies in the EMEA region achieving this seemingly improbable balance of speed, performance and compliance?

Why is EMEA payroll compliance so complicated?

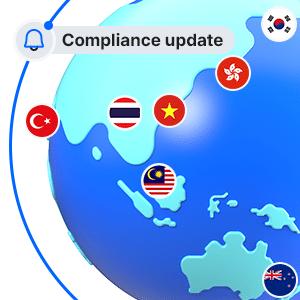

Firstly, it’s important to note that EMEA is made up of a very large number of relatively small countries, all of which have their own sets of regulations and legal requirements across multiple jurisdictions.

This fragmentation creates significant compliance challenges for organizations operating across multiple territories—complexity that intensifies when you factor in the vastly different business cultures between Western Europe and the Middle East, for example, not to mention varying social security systems, local tax codes, and reporting requirements.

It’s for this reason that EMEA’s calendar length has traditionally been longer than those in the other regions. But as the table below demonstrates, EMEA’s has reduced this year and has outstripped the others in performance:

Calendar length by region (days)

| Region | 2023 | 2024 | Difference |

|---|---|---|---|

| EMEA | 8.2 | 7.1 | -13.4% |

| Asia-Pacific | 4.1 | 6.2 | +48.8% |

| Americas | 5.8 | 5.4 | -6.9% |

But while a shorter calendar length traditionally suggests rushed payroll and more errors, this hasn’t stopped many EMEA countries achieving strong performance. The PEI Matrix, which contrasts payroll complexity and efficiency, highlights Luxembourg and the Netherlands as stand-out performers despite appearing in the “most difficult, most efficient” quadrant. And Croatia has recorded the lowest rates globally for both data input issues (0.03) and supplementary impact (0.00).

How does EMEA manage the speed-compliance balance?

So how have EMEA countries done it? Well, for starters, these countries are generally more likely to have implemented payroll technology, including automation. Being early adopters in this area is now starting to pay off, as EMEA countries have mature payroll systems that can handle complexity more effectively across different regions. But there are other factors at play, too:

- Strong validation culture: EMEA has long had a strong focus on validation and tax compliance without unduly extending payroll timelines. This is why EMEA has been able to capture more issues, while shortening calendar length and only experiencing a drop of 1.05 percentage points in FTA

- Process refinements: reduced calendar length points to process refinements that combine rigor and efficiency, optimizing a thorough approach through better workflows and validation points to streamline payroll processes

- Automated measurement systems: this year’s PEI report features a new DII measurement system that accounts for real-time automated capture. EMEA’s low rate of 0.49, in conjunction with a low rate of 3.63 issues per 1000 payslips, demonstrates how automation is catching issues earlier in the process, preventing downstream errors, and cutting manual validation work—helping to ensure accurate payroll delivery on time

- Regional stability: the fact that EMEA’s SI rate has remained stable at 13.60%, an increase of only 0.88 percentage points, demonstrates that EMEA organizations have the infrastructure in place to maintain scheduled cycles despite all the complexity and avoid non-compliance

How can your organization strike that same balance?

The EMEA businesses that are getting both speed and compliance right are enjoying a significant advantage in their payroll efficiency. And in a globalized business landscape, it’s up to everyone else – wherever they are in the world – to achieve the same results. After all, if it can be achieved in EMEA, with all the complexity of payroll regulations, local laws, GDPR, income tax, payroll tax, and employee data protection requirements, then it can be achieved anywhere.

This is where CloudPay’s ‘three As’ approach can be so invaluable, bringing three key strands of technology together to handle diverse regulatory requirements without sacrificing speed or accuracy:

- Automation: cutting out the manual processes that often cause delays and errors while supporting automated payroll and compliant payroll delivery

- AI: using predictive analytics and automated validation to catch compliance issues proactively across diverse markets and different sets of regulations

- APIs: enabling seamless data flows between HCM, payroll and compliance systems to ease the process of integration, and to mitigate the risk of fragmented country-specific interfaces

These technologies work best as an integrated ecosystem, where AI validates data, APIs allow it to move seamlessly across borders and systems, and automation takes care of payroll compliance checks even when data definitions aren’t standardized. And that ecosystem should combine with high-touch human expertise that adds business-specific context and support as and when it’s needed.