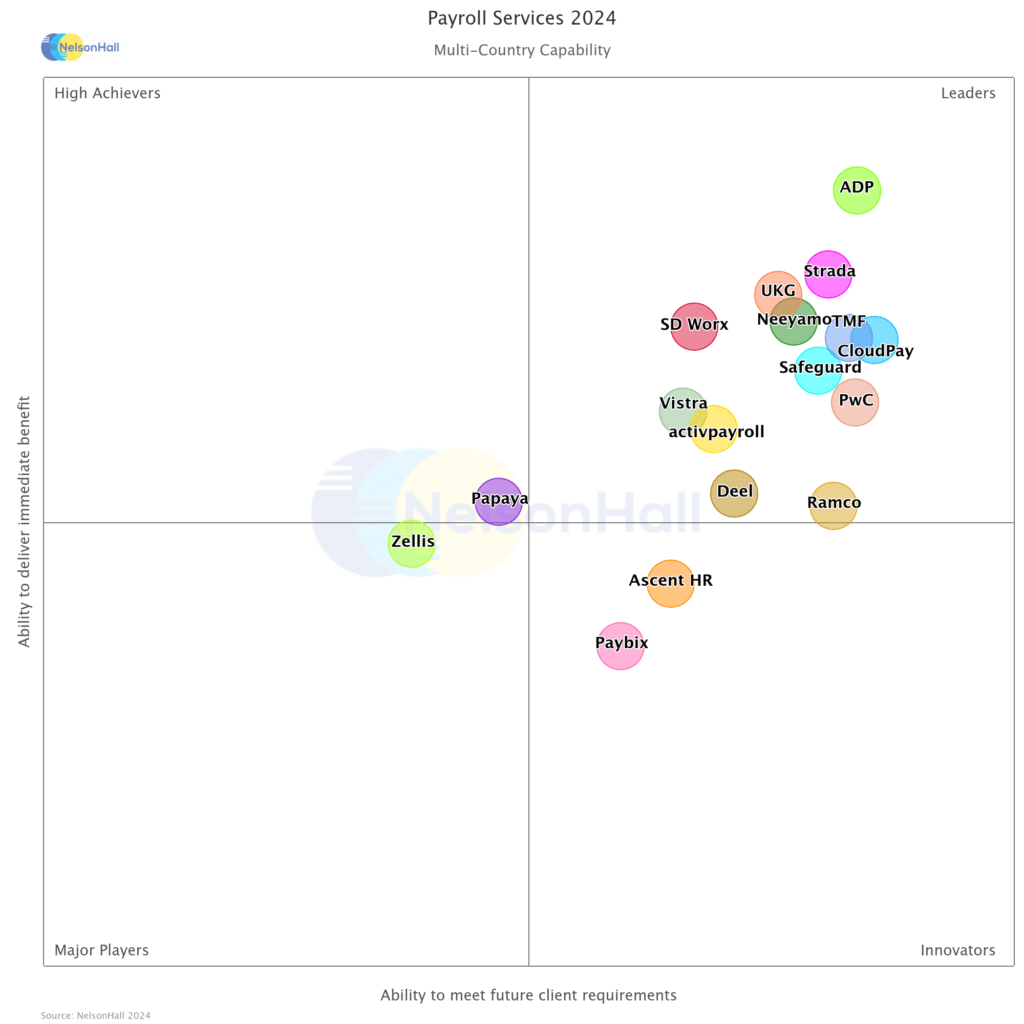

For the fifth year since 2019, CloudPay has been recognised as a Leader in NelsonHall’s 2024 Payroll Services NEAT evaluation. This year has seen a marked difference as CloudPay shifts towards the top right of the quadrant, highlighting a significant leap forward in both Multi-Country and Digital Payroll capabilities – with the company now rated highly for its ability to meet future client needs for Multi-Country payroll in particular.

What have CloudPay done differently to warrant our improved position?

Over the past twelve months key advancements have been implemented to improve our offering, from enhanced automation capabilities to key HCM integrations. Here, we take a look at some of the innovations that have helped CloudPay set a new standard in global payroll.

Redesigned platform workflow

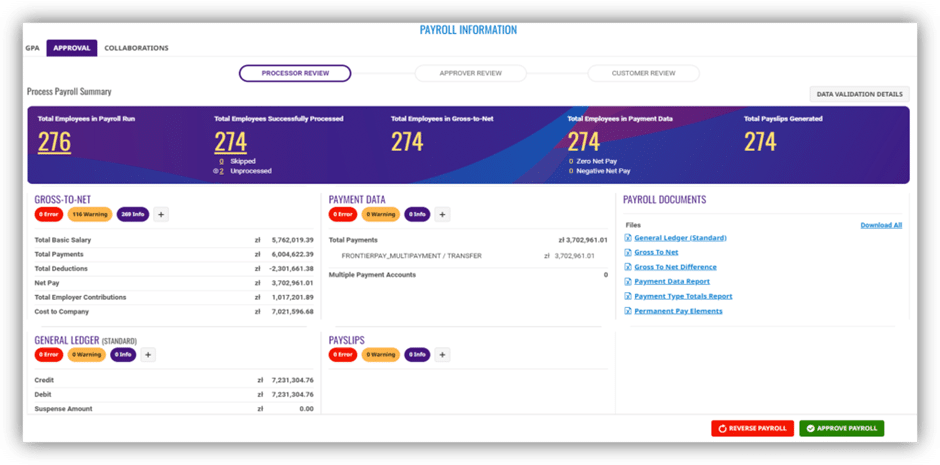

A major leap forward was when CloudPay introduced its new Approval Workflow Process, replacing the previous file-based approval system, resulting in less manual and more efficient payroll cycles. This new process is a four-step, self-service workflow that allows customers to approve payrolls faster and with increased certainty.

All the critical data you need can now be viewed on a single screen. This makes the decision-making process during payroll approval simpler. Key steps, prominent processing statistics, and important exceptions—like negative net payments—are immediately visible. The platform offers comprehensive payroll summaries with the option to delve into the finer details. Essential payroll reports are now readily available for instant download, ensuring quick access to detailed validation, and payroll results can be easily approved or rejected with just a single click.

Last month, the platform was made even more user-friendly. The Period Overview on the Payroll Information screen now offers a cleaner view of all payroll runs and tasks, and supplementary payroll runs will be auto-generated if set up in the calendar.

Payroll management automation

Our updated and improved condition-based automation framework allows the team to automate workflow steps based on specific conditions. This means your teams are free to focus on more complex tasks, because payrolls meeting the right conditions can be progressed with minimal human involvement.

Payroll run changes are now automatically validated and the necessary pre-processing reports are generated. Once the payroll run is processed, the framework integrates employee payslips with the CloudPay system and, once validated, the payslip batch is published.

This results in early validation of payslip batches, eliminating the need for manual integration by internal service teams. Once the final approval is completed, all necessary signoff and GL reports are automatically generated and saved, ready for the customer to access.

Of course, we are always assessing new ways to improve automations. As of September 27th, we’ve introduced new automation features for payroll management, including automatic data imports and payroll locks when calendar dates are met. Now customers can request a one-time 24-hour extension with a single click.

Local Payroll Information

CloudPay first introduced Local Payroll Information (LPI) years ago as a framework to support country-specific payroll data by providing one standardized template for each country. It enabled all country-specific employee data to be managed, validated, and reported on in the same way as any other employee data provided for the payroll process.

In the past year, CloudPay added coverage for Brazil, Romania, Argentina, The Czech Republic, Switzerland and Sweden to an already long list of countries covered, enabling even more consistent multi-country payroll coverage.

User-centric app features

This year, CloudPay launched new in-app digital payslip functionality for the CloudPay NOW app. As well as promoting financial well-being by granting employees immediate access to their earned wages, the app now enables employees to seamlessly view, manage, and download their payslips and year-end tax documents anytime, anywhere. Naturally, this improves employee satisfaction, leading to an engaged workforce.

These improvements ease the burden on payroll departments, reducing manual requests, in turn saving time and resources. The ability to access and download year-end tax documents within the app marks a key step towards simplifying financial management for both employees and payroll teams alike.

HCM integrations

CloudPay are always looking for ways to improve solutions with leading HCM platforms. This year has seen the rollout of the highly anticipated Global Payroll Connect solution with Workday. This best-in-class, end-to-end global payroll integration enhances payroll accuracy and efficiency by leveraging advanced AI-driven validation technology, enabling Workday users to capitalize on the value of significantly enhanced automation, integration, and control on offer through direct API integrations.

For more on CloudPay’s latest innovations in partnership with Workday, our recent webinar showcases the new features of the Workday + CloudPay HCM payroll solution.

Very soon, anyone using CloudPay’s integrations with Oracle will also benefit from the latest payroll innovations. Data will automatically be retrieved from Oracle HCM, eliminating manual interventions, and our seamless bi-directional integration will return payroll data to Oracle after the payroll run. Users will still be in control, as data is transferred from Oracle to CloudPay at their chosen frequency with immediate validation, and any errors will be flagged for correction directly in Oracle.

“CloudPay is a Leader in the Digital Payroll Capability and Multi-Country Capability market segments, having developed significant capability to deliver digital multi-country payroll services over the past year, whilst establishing a robust roadmap that supports customer journeys, a high quality of service, and high degree of efficiency.”

– Liz Rennie, NelsonHall’s HR & Talent Transformation Research Director

The future of payroll innovation

NelsonHall’s recognition of CloudPay as a payroll leader comes at a pivotal moment. Recent investment in product innovation – fueled by our recent $120 million funding round led by Blue Owl – is driving the launch of the next generation of optimizations and AI-powered capabilities, including payroll output reconciliation, G2N reconciliation, and PDF payslip generation.

To learn more about how CloudPay can transform your payroll operations using the above-mentioned innovations and more, get in touch and discover the future of payroll today.