Every year, Workday Rising US not only brings together people from across the global HR, finance and payroll industry, but it also unearths new insights and ways of thinking around technology innovation for the future.

This year’s event on September 16-19 in Las Vegas was full of expert-led sessions, hands-on experiences, and networking opportunities for thousands of attendees. As a trusted partner of Workday since 2012, we at CloudPay have seen how areas of focus have changed among attendees over the years – and in 2024, “touchless payroll” was one of the key conversations that we were pleased to be a part of.

But what does this mean for payroll in practice – and how should organizations like yours go about adopting it?

Touchless payroll: a journey, not a switch

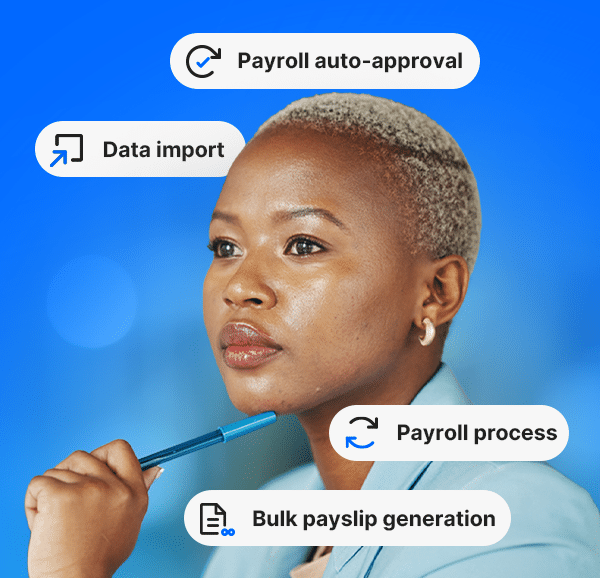

Touchless payroll – often referred to as zero-touch payroll – is the principle of removing manual input from as many points of the payroll cycle as possible, and handing those tasks over to automated technology. Given that as many as 72% of payroll organizations still rely on manual processes, it’s clear to see that moving towards touchless payroll represents a major change to some long-standing payroll practices.

With touchless payroll implemented correctly, organizations can benefit from better-coordinated global payroll experiences based on improved data quality and encouraging better engagement with your HCM. Employees can get paid wherever they are in the world, once they’ve logged their work or timesheets thanks to real-time processing capabilities; this removes much of the stress and delay that can be caused by long approval chains, or by disparities in time zones.

However, making touchless payroll a success doesn’t happen overnight. The payroll team, for example, will be substantially repositioned. With so much data living in consolidated systems, so much of the data journey automated, and with controls well-defined, the payroll team effectively becomes the ‘last line of defence’ to step in when the unexpected happens.

At the same time, system integrations are evolving at record pace, and systems’ capacity to house large volumes of data is expanding exponentially. That’s why touchless payroll should incorporate medium and long-term strategies that enable more reliable automation, driven by machine learning and AI, and supported by human payroll expertise.

How can you achieve touchless payroll successfully?

The ultimate goal that CloudPay and other global payroll providers are working towards is a never-ending finish line of automation evolution, adoption of new technology, and seamless employee experiences. Integrated software environments are a vital part of achieving that, and help ensure that the new approach delivers the results employers and employees alike are looking for.

The most practical way to make touchless payroll work is to integrate an HCM platform like Workday with a global payroll platform. Many leading payroll providers are already actively incorporating AI, machine learning and Robotic Process Automation, and this is key to ensuring that the technology behind touchless payroll works reliably.

Our four key principles for a touchless payroll strategy

- Take it step by step: identify manual processes that are ripe to be automated, and explore partial automation where possible with the use of advanced technology

- Start small: if running payroll in multiple territories, start the rollout with smaller countries where payroll is simpler. Then use the lessons learned when expanding to bigger, more complex payroll territories

- Stay flexible: be prepared to adjust as you go, taking change management into account and taking people on the journey

- Trust but verify: ensure that the payroll team is established as the final point of control. However much automation is used, the payroll team remains ultimately responsible for payroll accuracy and timeliness, and so robust controls and checks are vital to maximize results and to stay prepared for audits

A week of discovery at Workday Rising US

Touchless payroll wasn’t the only exciting development at Workday Rising US. Throughout the four days, attendees and partners also got to explore:

- Partner initiatives: there was a stronger focus from Workday on partners. New innovations included in the recently announced Global Payroll Connect suite were a particular highlight, and more partners were racing to adopt future-ready, direct API-driven integrations for better insight flows and improved customer experiences

- New SI partners: a range of new Workday partners are offering unique ways to leverage functions and maximize value from the Workday platform, by attaching Prism or Extend amongst others

- Stakeholder voices: this is the moment for payroll stakeholders in the Workday ecosystem to make themselves heard internally as we saw a range of payroll providers introducing new GPC features that deliver enhanced automation, integration and control (many of which CloudPay have available already)

- Relationship strengthening: we got to spend valuable face time with customers and partners, helping us stay aligned and deepening our professional and personal relationships, which it’s really all about

CloudPay on tour

It was great to meet so many passionate payroll practitioners at Workday Rising US, and to catch up with some long-term partners and peers, too.

We’re still on the road all over the world at other events where we’re looking forward to connecting with all types of businesses and learn more about how we can support you with your modern pay experience. Last week we attended CIPP ACE24 in Wales and this week we’ve been bringing together the brightest minds in global payroll for an unforgettable Paymakers 2024 in Athens! And coming up, we’re looking forward to sponsoring Workday Rising EMEA 2024 in Amsterdam this December.

Find out more about how the CloudPay modern pay experience can help you achieve touchless payroll here.

You can also read about integrating CloudPay with Workday to maximize the value you’re getting.