Payroll has historically been a relatively quiet function within a business, that only really made itself known to finance, human resources, and other departments when something went wrong.

But the fundamental changes in the business world of late – more remote working, increased digitization, and the cost of living crisis – have shaken up the established order of things. As the roles of work and earnings have changed within people’s lives, payroll is now viewed very differently.

This results in an acceleration in the innovation, integration, and strategic function of payroll, particularly over the last 1-2 years. In this blog, we’ll explore the five biggest factors that are driving this trend, and how it’s enabling the shift towards the modern pay experience.

Reacting to changing employee attitudes

The world of consumer finance is evolving very quickly, and payroll has to respond to changing needs. For example, SAP research has found that 56% of employees worry that delayed reimbursements of expenses will impact their personal finances.

Now more than ever, employees expect good experiences from their employers, and pay-related issues are no exception to this. Employees want to be able to access applications and technologies that give them more flexibility, speed and transparency in their pay such as on-demand pay platforms (also known as Earned Wage Access). This also comes hand-in-hand with financial well-being support, such as wellness programs, education and financial planning services, and the use of faster payment rails to cut the lead times within payroll processing.

A post-pandemic shift towards tech

Even the most technology-averse organizations have moved towards greater digitization in recent years, whether they wanted to or not. Many businesses have enjoyed the flexibility that cloud documents and video collaboration gave them throughout the pandemic, for example, and have stuck with these new technologies in the long term.

From an HR and payroll perspective, it’s become necessary to modernize systems, technologies, and procedures to meet the needs of an increasingly flexible and distributed workforce. This often includes wider use of cloud-based payroll solutions and virtual HR services, using automation and artificial intelligence to streamline processes, digitizing payments to speed up payroll cycles, and using chatbots to handle employee inquiries.

Realizing the benefits of integration

Businesses are starting to notice just how beneficial it can be to integrate payroll systems with other areas, such as payments and treasury, and Human Capital Management (HCM) platforms. Such integrations are helping improve payroll performance, deliver better employee experiences through interconnected functions, and support more consistent data and better compliance.

Taking this further, better integration allows more detailed analytics to be conducted, helping uncover greater insights into business operations, across payroll and far beyond. This can inform better decision-making in the long term and uncover areas where employee experiences can be improved even further. Plus, cutting out the data duplication and errors caused by manual methods can help reduce the number of data input issues in payroll processing – a reality that was a key finding of the 2023 PEI report, which uncovered a link between increased innovation and improvements in key payroll KPIs.

Globalization

With many of the geographical barriers to work and recruitment broken down, payroll and HR need global solutions that enable them to serve all employees, wherever they are in the world.

Some businesses have addressed this by bringing together many different third-party payroll solutions into a piecemeal global system, but this approach regularly leads to delays, errors, and problems caused by a lack of integration. Instead, there’s an increased clamor for a single global solution that makes payroll processing as easy as possible across multiple territories, time zones, currencies, and tax regimes. Solutions that incorporate local and cultural expertise, in order to account for any regional variations, often deliver the best results.

Compliance

From financial regulation to data protection, compliance demands within the business world are increasing all the time. Keeping up with these demands has become especially difficult with global workforces and flexible working, and there is therefore a more significant disparity between the arrangements of one employee or department and another.

The best way businesses are finding to solve this issue is to turn towards fully managed payroll services, rather than just outsourcing certain functions. With this holistic approach, larger organizations in particular are finding it much easier to keep on top of their responsibilities and adjust to any regulatory changes, in partnership with their global payroll provider.

In summary

The combination of all five of the factors listed above have created a culture of fast, transformative innovation in payroll. In particular, reliance on manual processes conducted in-house by payroll teams is being substantially scaled back, which can help organizations:

- Ensure every employee is paid accurately and on time, every time, with the flexibility to be paid on-demand if needed

- Keep track of cash flow and salary payments in ways that are quicker and easier for the payroll department

- Deliver the positive, motivating experiences with pay that employees are looking for

The businesses that are already pursuing new innovations and gaining from these benefits, across payroll and in other areas, are gaining genuine competitive advantage. So there’s no time to lose for those who aren’t.

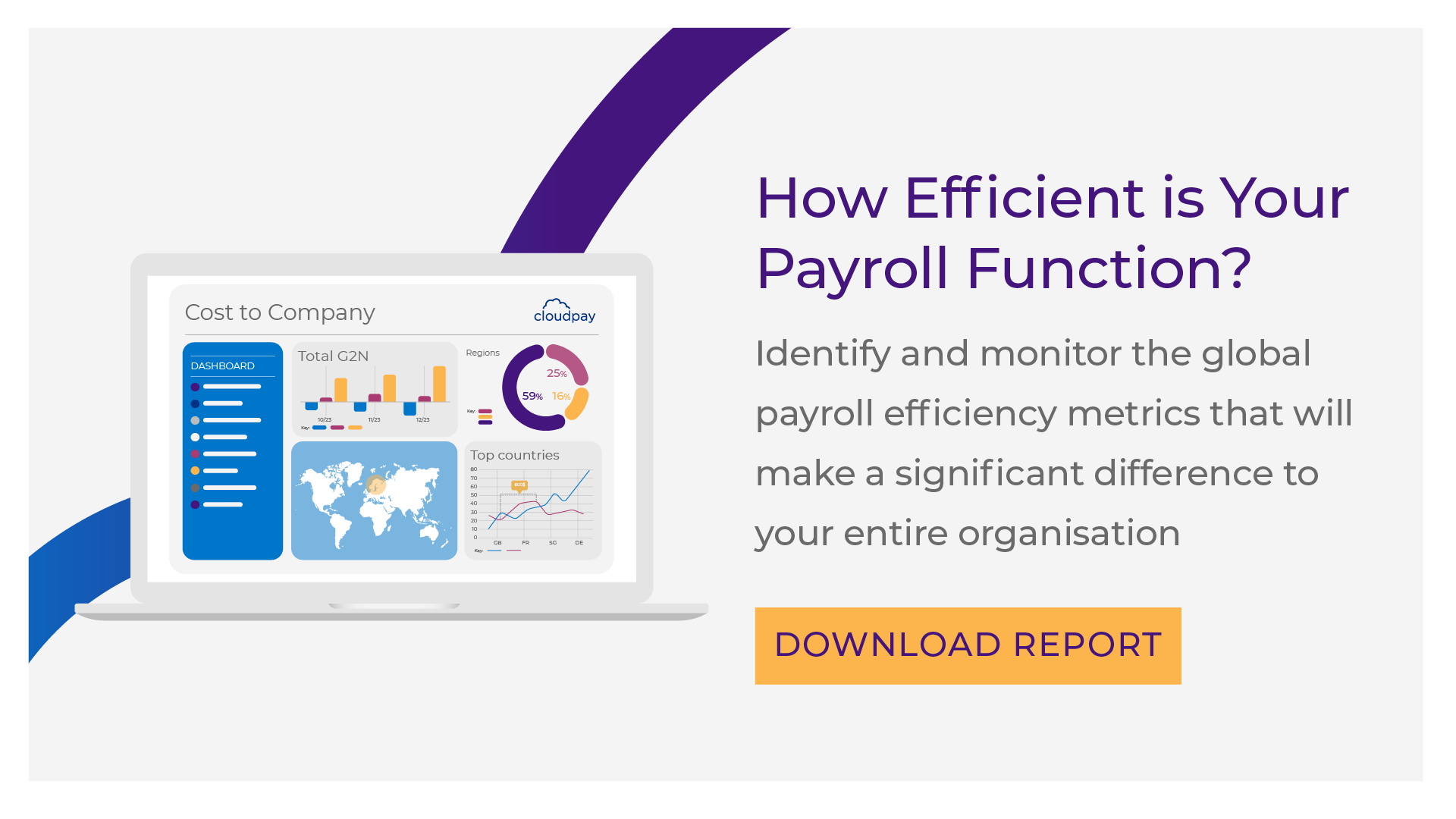

Find out how CloudPay can support your quest for payroll innovations by getting in touch with our team, and read our Payroll Efficiency Index report to see how tech is influencing global payroll performance.