Key performance indicators (KPIs) can be incredibly useful for businesses trying to understand and quantify their payroll performance. The only problem is that the most ubiquitous metrics used by payroll teams all over the world, such as timeliness and accuracy, are only really scratching the surface.

As an example of how they aren’t really telling the overall story, our recent research has found that the current rate of global payroll accuracy is 99.9%. That sounds great at first glance, but it says nothing about how that figure was achieved, and what is and isn’t working underneath the service.

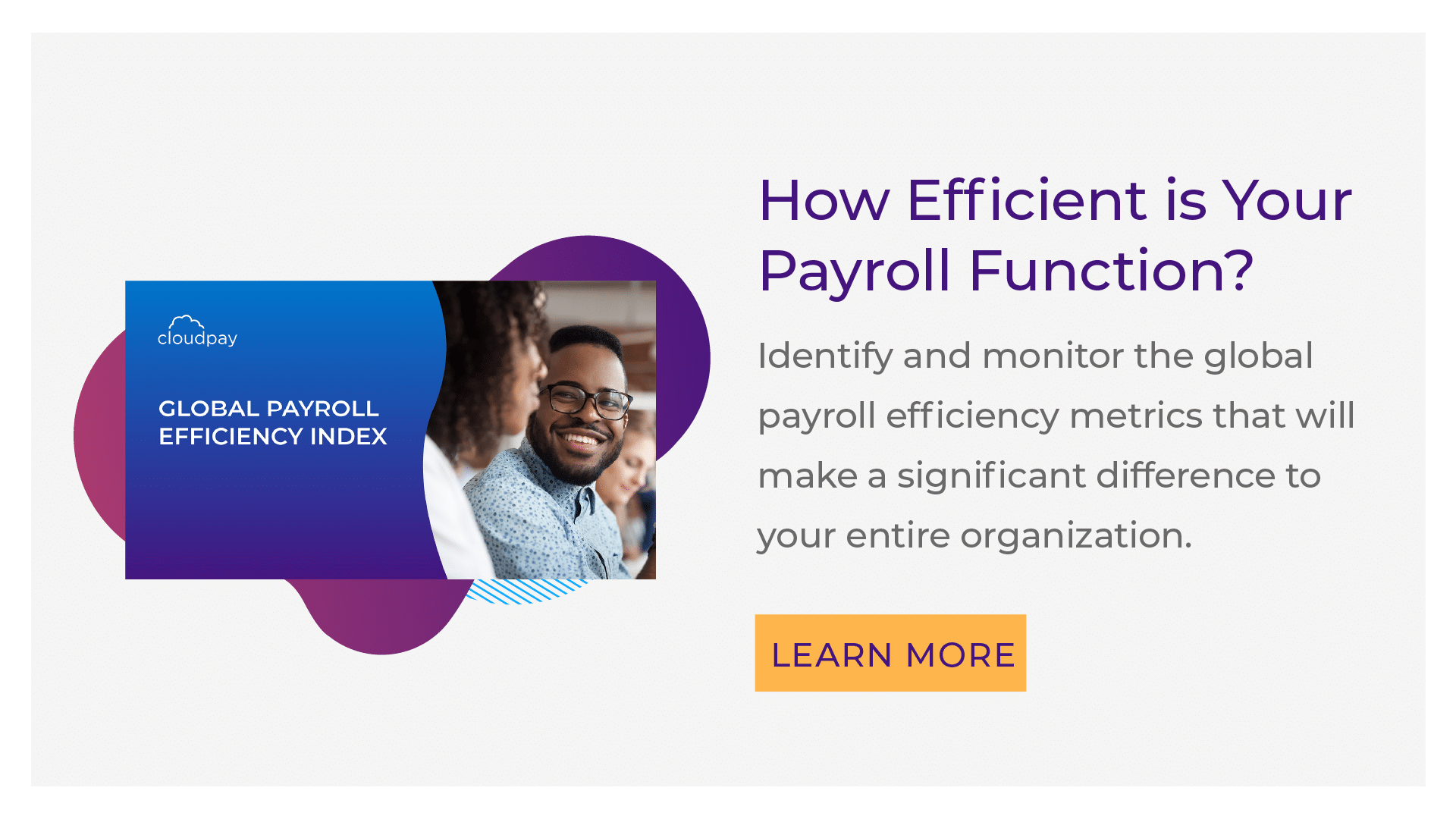

That’s why we at CloudPay advocate the use of more focused, specific payroll KPIs that shed light on areas where payroll is running very well, and areas where improvement is needed. By measuring these over time, businesses are better able to make long-term, strategic decisions around their payroll operations, and focus time and resources on the areas where efficiencies and improvements can be found.

The five vital Payroll KPIs

Just about anything can be measured and tracked in payroll (and often is!). However, you can have too much of a good thing: generating too much data can make it harder to draw genuine conclusions and make the right decisions. For this reason, we recommend that all payroll operations benchmark themselves against these five KPIs, all of which deliver insight at both payroll and wider business levels:

-

First-time approvals (FTA): this is the percentage of payroll runs that get approved without any changes being made, and at the first time of asking. This is used as a bellwether of overall payroll efficiency, as any issues with data input processes, payroll data quality or approval workflows will bring this rate down. It’s therefore a useful monitor of wider company health as it can flag up payroll problems that can have impacts business-wide.

-

Data input issues (DII): this important metric measures the extent of how data input problems affect payroll, as a proportion of all issues. Poor collection methods, errors in data transfer and other human errors all bring this rate up, and so it’s a good KPI for finding out how much attention the human element of the payroll operation requires.

-

Issues per 1000 payslips (I/1000): this simple metric measures the number of payslips affected by an issue of any kind. This makes it very useful for explaining how well payroll is running to senior managers or others within a business who aren’t well-versed in payroll. It also makes it very easy to analyze progress all the time as the number fluctuates.

-

Calendar length: this is the length of time (usually measured in days) that it takes to complete a normal payroll run from start to finish. This can be influenced by lots of different things, such as the accuracy of data or the skill of the payroll team. As such it isn’t always useful as a direct barometer of progress, but can be valuable when certain calendar length targets are set, and changes to processes influence the length either way.

-

Supplemental impact: this is the total number of all payroll runs that aren’t conducted within the usual cycle. The more supplemental runs that a payroll team has to devote its time to, the more strain it puts on them to get all their work done. Making adjustments to reduce off-cycle runs can ease this rate, although it should be noted that local and cultural norms can also impact this metric to different extents.

How KPIs can help diagnose problems

When you consider several of these KPIs in context with each other, you can spot anomalies or trends that can help you pinpoint the source of problems in your payroll processing. As a hypothetical example, consider the case of this fictional business that we’ve called Global Business Ltd.

Measurement of these five KPIs has found that Global Business Ltd has a very short calendar length, which suggests that normal payroll runs are operating very efficiently. However, a look at the other KPIs uncovered an unusually high supplemental impact rate. Taking these results together suggests that the calendar length is a little too short: that is to say that payroll runs are being rushed through without all the proper validations being made. As a result, many errors weren’t being picked up on, which then had to be corrected by regular supplemental runs.

By looking at these payroll performance metrics together, Global Business Ltd is able to identify the source of the problem, and slow calendar length down by allowing more time for validations to take place.

In summary

What success looks like for a payroll department will always vary, depending on the nature of the business and industry. However, these five KPIs can collectively measure how efficient your payroll processing is, especially when compared to regional and global benchmarks. Explore those benchmarks, and learn more about each of these KPIs, in the latest edition of the CloudPay Global Payroll Efficiency Index.