Jon Kulczycki |Earned Wage Access Consultant, CloudPay NOW

If you’ve only ever worked in a highly developed country in the West, then you’ll probably be used to being paid at regular intervals, most likely on a fixed date each month. It’s easy, therefore, to assume things work the same in most countries around the world – but that simply isn’t the case.

Pay frequency can vary substantially, depending on the history, economy and cultures of different countries, and within different industries. And if you’re running global payroll, it’s absolutely critical that you understand the what, when and why of these variations. In this blog, we’ll take a close look at pay frequency, and highlight some of the key differences across developed and developing economies worldwide.

What is pay frequency?

Pay frequency is, in its simplest form, the regularly spaced intervals at which employees receive their wages. There are several different common options for pay frequency, each of which has its own benefits and drawbacks:

-

Weekly: can be any day of the week in principle, but Friday is most common. It’s most useful for employees who want to receive pay sooner and more regularly, especially if they’ve worked overtime, and can help them manage their cash flow better. However, weekly pay cycles are more expensive and time-consuming for businesses to run.

-

Bi-weekly: employees get paid on a specific day of the week, every second week. It makes payroll administration easier and cheaper, but can make things complicated for employees. They’ll receive their pay on different dates each month, and sometimes will get three in a month rather than two, making it harder for them to manage their finances.

-

Semi-monthly: employees get paid on specific dates twice a month. This removes the headaches of dates and leap years that come with bi-weekly pay, and gives employees more stability in their cash flow. But it makes overtime calculations harder as some weeks end up getting split across two paychecks.

-

Monthly: paying employees on 12 fixed dates a year is the cheapest from a payroll perspective and is the easiest option for administering taxes and other contributions to the government. However, monthly pay is prone to putting financial strain on employees who struggle to manage their finances over such a long period of time.

Pay frequency by region

Pay frequency trends can vary enormously from country to country. However, there are some patterns that emerge in certain regions of the world, for a variety of reasons:

-

The Americas: the relatively relaxed employment laws in the United States are reflected in the variance in payroll frequency and rules in different states; biweekly is the most common method nationwide. Similarly, regulations in Canada allow employers to choose how often employees are paid, as long as it happens on a consistent, recurring schedule. South America, however, tends to be somewhat different: in Brazil, employees must be paid at least once a month, and receive a 13th-month bonus towards the end of each year.

-

Europe, the Middle East and Africa: there are many interesting variations across this region according to employment status. In Belgium, white-collar workers are paid monthly and blue-collar workers at least semi-monthly. In Zambia, employees are paid weekly, bi-weekly or monthly, depending on what is agreed in contracts of employment, similar to arrangements in the United Kingdom. And in Qatar, employees receive monthly payments if hired under a contract specifying as such, otherwise it’s bi-weekly.

-

Asia-Pacific: many Asian countries are fairly consistent in paying employees monthly, and that is certainly the case in India, Hong Kong, and China (although part-time Chinese employees should be paid at least semi-monthly). Bonuses are also common in these countries: 13th-month bonuses in China and Hong Kong, and profit-sharing bonuses in India. On the other hand, in Russia is at least semi-monthly for all employees.

Deciding pay frequency

As you’ve already read, there are lots of factors to consider when selecting a pay schedule from an employee friendliness perspective. Generally speaking, employees paid more regularly can better manage their finances. However, that is counterbalanced by the administrative burden placed upon the payroll team, while local laws and logistics also have to be taken into consideration.

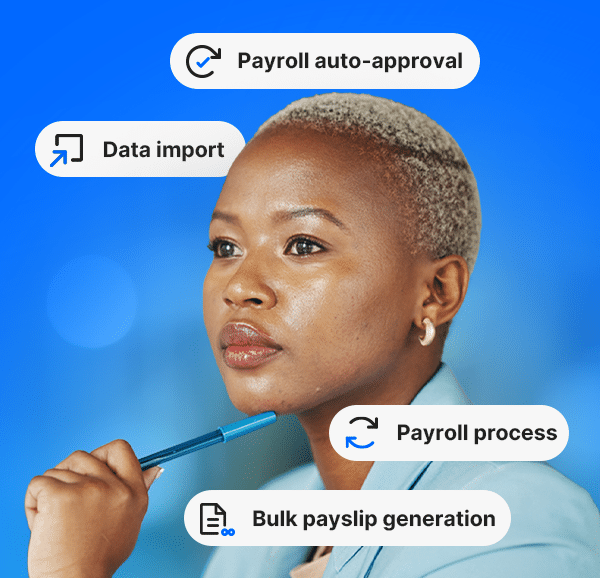

If you feel that all of the pay frequency options listed above would be too much of a compromise, then it’s worth considering an Earned Wage Access solution like CloudPay Now, where employees can autonomously withdraw accrued wages whenever they want. This delivers the best of both worlds in giving employees full flexibility around their pay, while minimizing the admin burden on the payroll team.

In any case, understanding exactly which strategy is right for your business can be difficult, and that’s where the help of an expert partner comes in. They can draw on experience with payroll all over the world to advise on which choice would be best for the specific characteristics of your organization.

{% video_player “embed_player” overrideable=False, type=’scriptV4′, hide_playlist=True, viral_sharing=False, embed_button=False, autoplay=False, hidden_controls=False, loop=False, muted=False, full_width=False, width=’600′, height=’338′, player_id=’50614404162′, style=” %}

To find out more on perfecting your pay frequency strategy, explore CloudPay’s managed global payroll services, and read our helpful country guides on running payroll in dozens of territories worldwide.