Nick Newman | Strategic Initiatives Director, Treasury Services, CloudPay

A faster way to pay employees

The banking system has been relied upon by businesses to pay their employees for several decades. Services like BACS, ACH, and SEPA have become widely accepted standards, even though they typically take two or three days to process. But things are changing.

It’s now possible to pay employees instantly to their debit or credit card instead. This ‘pay-to-card’ system uses the card rails network, and once payments are set up and validated, money can be deposited into an employee’s account virtually anywhere in the world in as little as 30 seconds.

In this blog, we’ll explore how instant salary payments work in detail, how to get them up and running, and why it makes sense for employees, businesses, and payroll teams alike.

What are payment rails?

Firstly, to understand how instant salary payments work, it’s important to distinguish the technology behind it: in this case, the payment rail.

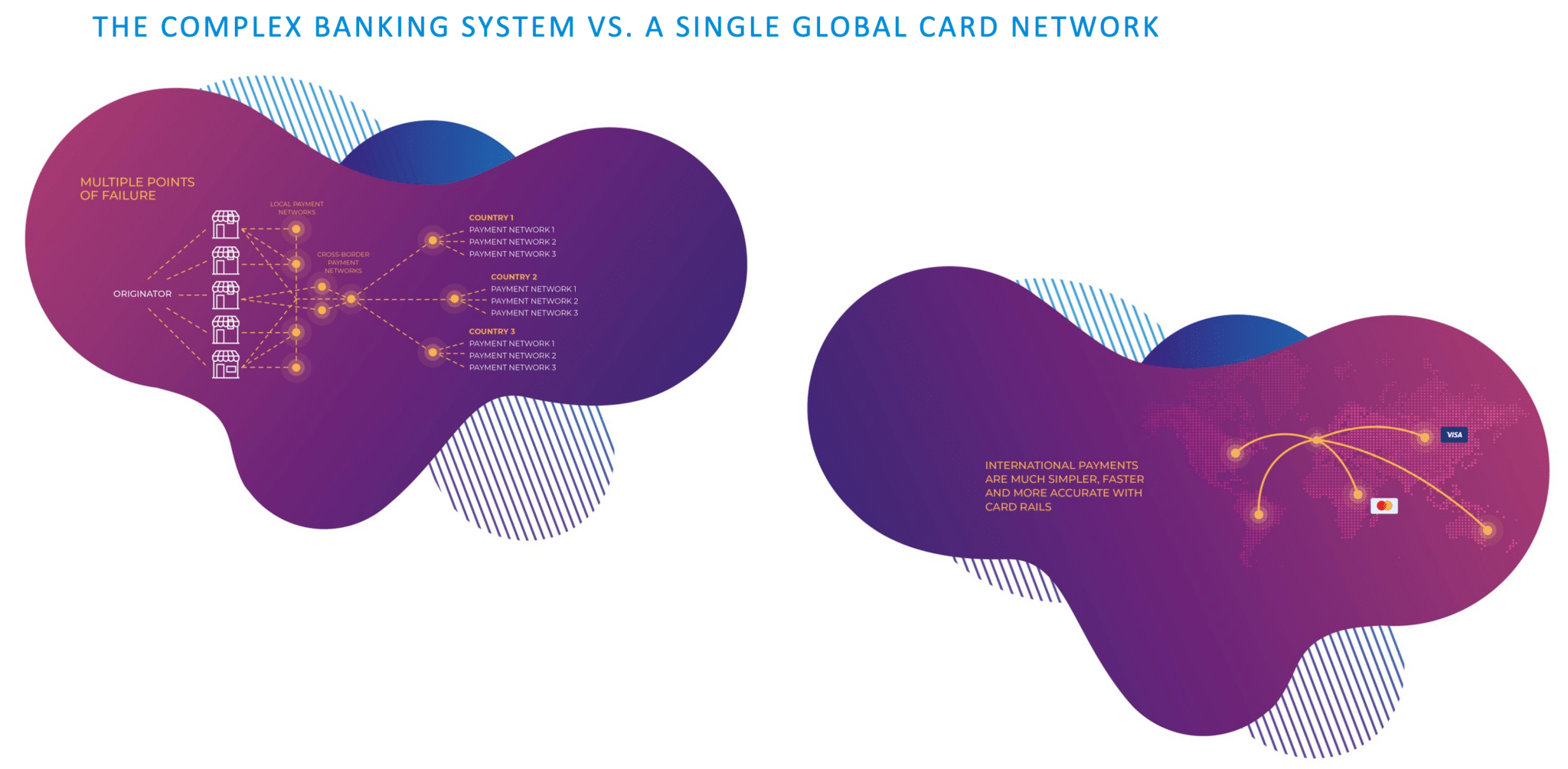

Payment rails are platforms or networks for moving money from a payer to a payee. Previously, there was only one type of rail available to businesses for paying their employees, and that was banking rails: where transfers are routed through a number of different banks and networks.

However, thanks to innovators like CloudPay, it’s now possible to make instant salary payments using card rails. This uses a single network and is therefore much simpler and quicker to execute. Not only does this give employers more choice in how they pay their workforces, but allows them to do so faster, securely and accurately. And it doesn’t cost any more.

How are instant salary payments set up?

No longer does payroll have to go through the laborious process of setting up monthly salary payments by uploading full banking details, validating with a nominal-value transaction, and getting confirmation from the employee. A good thing, too, as this process is prone to errors, takes far too long, and adds an extra administrative burden on a payroll team.

Setting up instant salary payments is pretty much as simple as buying goods and services over the internet. The only information needed is for the cardholder to validate their account with their card issuer via a simple process. Their card details are not retained in any way as a unique token is passed from the issuer to the app securing the cardholder’s details. This can be validated instantly so that the payment can be processed immediately, and can be carried out at any time.

How do instant salary payments improve the employee experience?

Instant salary payments might seem like they won’t make much difference to employees in the grand scheme of things. After all, as long as they’re still getting paid, they might not notice much difference.

However, the world of work is changing. Employees increasingly want more flexibility and better experiences that fit in better with their personal lives. And if they don’t get them from their current employers, they are far more open to looking for alternative employment.

Instant salary payments are useful in this regard as they can open up flexibility in how and when employees are paid. No longer do they have to be tied to fixed monthly payroll dates: combined with advances in mobile apps and FinTech innovation, instant salary payments can form part of a self-service payroll setup that puts individual employees in autonomous control of their payroll arrangements.

Additionally, instant salary payments are more accurate, reducing any queries or headaches caused by payroll errors. It also means the employee has access to their funds anywhere within minutes not days or hours.

How do instant salary payments help payroll teams and wider businesses?

Instant salary payments are hugely beneficial on the employer’s side, too. For payroll teams, they can enjoy operational efficiencies through the drastically reduced time needed to set up payees and to run payment cycles. This extra time saved can be put to good use in devoting more time to data checks, therefore cutting back on errors even further.

Theoretically, this should mean that the need for supplemental and off-cycle runs is reduced; but in any case, making these payments when they are needed (e.g. to reimburse employee expenses) is made much easier with direct deposit through instant salary payments.

Businesses as a whole benefit from a smooth-running payroll operation that employees are satisfied with and that supports their efforts to improve employee experiences. And there’s a financial upside, too: as salary payments can now be processed on payroll day rather than having to be done 2-3 days ahead, capital can stay in employer bank accounts for longer, aiding cash flow and potentially boosting interest payments.

In summary

When all of the benefits of instant salary payments are considered, the legacy method of using banking rails to pay employees feels very old-fashioned and cumbersome. At a time when employees, employers and payroll teams alike are all looking for ways to reduce admin, save time and enable flexibility, it’s clear that instant salary payments tick all the boxes.

CloudPay, with payroll technology experience across more than 130 countries, is a leading innovator in enabling businesses like yours to set up instant salary payments quickly and easily. Visit our treasury services page to find out how we can help, or read this guide, for more information on instant salary payments.

You might also find our posts on alternative ways to pay employees and digital wallets interesting.

Nick Newman | Strategic Initiatives Director, Treasury Services, CloudPay